Tax And Accounting Treatment For Website Development Costs

Planning on building or updating the site for your company and not sure about the tax and accounting treatment for website development costs? Does it go under profit and loss and count as an expense? Or does it go on the balance sheet and count as an asset?

Haven’t a clue how to answer those questions? Don’t worry, you’ve come to the right place.

Before you can start determining the tax and accounting treatment for website development costs, you need to determine what you use your website for. You need to decide if your website is more of a brochure that publicises your brand, or if the purpose of your website is to sell goods.

If the purpose of your website is to publicise your brand

If your website isn’t for the direct purchasing of goods, and more about publicising your business, then the answer is pretty simple. The entire website development goes on your profit and loss statement.

For those of you who are unsure about what a profit and loss statement is – it’s a document that shows a company’s financial progress over a certain period. To show this progress you have to add up all the sources of revenue and the subtract all the expenses related to that revenue.

Generally speaking, having your website development as a profit and loss expenditure is good for tax because the smaller your official profits are, the less you’re taxed on.

The example of Adam the greengrocer

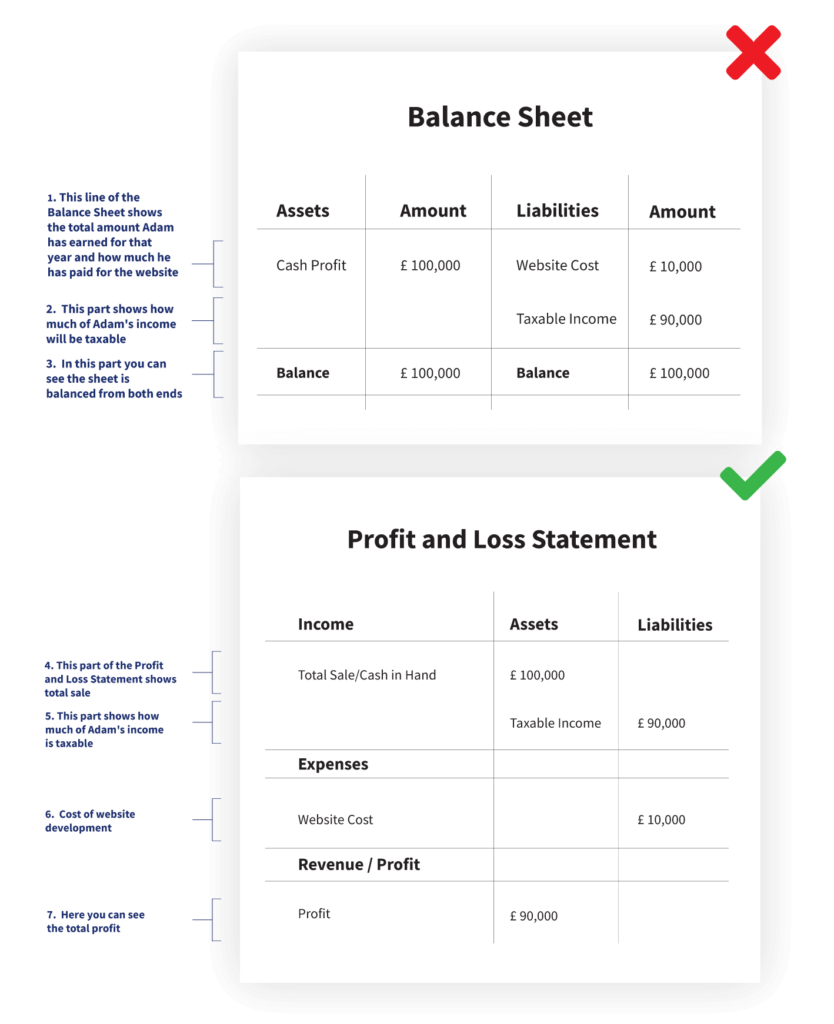

To illustrate, Adam owns a greengrocers. His customers don’t buy anything online – they all come to his shop. He made £100,000 profit this year. During that time he also built a website that cost him £10,000.

Because he doesn’t sell anything directly from his site Adam needs to put his website development costs on his profit and loss statement. He will therefore only be taxed on £90,000 (£100,000 profits minus the £10,000 he spent on the website). The taxman is happy and so is Adam.

If Adam had put his website on his balance sheet by mistake, he’d have been taxed on all his £100,000 profits. That’s why it’s important to get the tax treatment for your website development costs right!

If you’re unsure of what a balance sheet is – it’s a statement of the assets, liabilities and capital of a business.

If the purpose of your website is to sell goods

Now if the purpose of your website is for customers to buy things through it and to make a profit on those items, then the tax treatment of your website development gets a little bit more complicated. You can no longer simply stick your website development under profit and loss. Now at least part of it needs to go on the balance sheet. But which part?

According to the International Accounting Standards Board (via IAS 38 and SIC 32), different stages of the website build should have a different accounting treatment. The initial planning stage is an expense and goes on the profit and loss statement. The building of the website should be capitalised as an asset on the balance sheet. Any subsequent updates you make to the content of the website is treated as an expense.

The HMRC sums this up nicely: “the cost of a website is analogous to that of a shop window. The cost of constructing the window is capital (an asset on the balance sheet); the cost of changing the display from time to time is revenue (an expense on the profit and loss)”.

This also shows that the HMRC’s tax treatment for website development costs follows the accounting treatment.

For more tax guides, please read:

So what does this do to your tax bill?

The planning and website maintenance costs are considered an expense. This means they can be deducted from your profit and your tax bill.

The building of the website counts as capital and goes on the balance sheet. How this affects your tax bill will depend on whether you are an unincorporated business or a limited company.

If you’re an unincorporated business then the website build costs are eligible for capital allowances.

Capital allowances are an amount based on your capital expenditure that you can deduct from your taxable profit, in the same way as expenses.

Capital allowances vary from year to year depending on the Chancellor’s budget – hence the amount of your website build costs that are deducted from your taxable profits depends on the year.

Depending on the allowances for a particular year this might give a full deduction for your website development costs. This would give the same result for tax as if it had all been expensed. Alternatively, it may take a number of years to get a full deduction.

If you’re a company there is a special treatment that is the same as the accounting treatment stated earlier.

In your accounts, the asset on the balance sheet will have to be depreciated over the useful life of the website.

So, for example, if you think the website will last 3 years before you need a replacement, then you should depreciate it in equal instalments over 3 years on your profit and loss statement. The depreciation amount will also be deducted from your taxable profits.

If capital allowances would give you a better result than the special treatment above – in other words, if it will allow you to get the deduction more quickly – then you can choose to use capital allowances instead.

Tax and accounting for website costs, web hosting etc.

Tax and accounting treatment for website development costs can challenge small businesses. Small business owners must consider various upfront costs when creating a basic website.

Some entrepreneurs choose a small business website builder tool, which often provides a cost-effective solution for those with limited technical expertise only needing a few core pages. Most website builders typically offer templates and drag-and-drop interfaces, making it easier to create your own website without extensive coding knowledge.

Businesses requiring more customisation might hire a web designer to create a bespoke website, which can result in higher initial expenses but often leads to a more tailored online presence.

Professional design services generally fall under capital expenditures and may need amortisation over time rather than immediate expensing.

Web hosting represents an essential recurring cost for maintaining an online presence.

- Depending on the complexity, businesses may select shared hosting plans or a virtual private server for improved performance and more complete control. These ongoing expenses for dedicated hosting typically qualify as deductible ordinary business expenses for their own site in the year companies incur them.

- Ecommerce websites – especially large ecommerce sites – may incur additional costs, including payment processing fees, security measures, and specialised software. Companies usually can deduct these expenses, but they must categorise them correctly based on their nature and purpose.

The tax treatment of website costs varies depending on the expense’s nature and the accounting method used. Expenses related to planning and maintenance generally qualify as deductible in the year they occur.

Capitalisation considerations

Significant development costs may require capitalisation and amortisation over time. Businesses using a website builder to create their own business website typically treat subscription fees as ordinary business expenses.

Substantial customisation might necessitate capitalisation of a portion of these costs. Small businesses should note that website development costs incurred before official operations begin may qualify as start-up expenses.

Companies can deduct up to £5,000 of these costs in the first year of business, with any excess amortised over 15 years. Accountants must distinguish between different types of website costs from an accounting perspective.

- Expenses related to the web server or hardware infrastructure generally fall under depreciable equipment. Software costs, including those for a website builder tool, may follow different rules depending on whether companies purchase them outright or license them.

- Businesses developing a website in-house may capitalise labour costs associated with the application development stage. Expenses for routine updates and maintenance should appear as incurred costs.

Website costs for a small business can represent significant expenditures, but understanding how to properly account for and potentially deduct these expenses can provide valuable tax benefits.

Companies should maintain detailed records of all website-related expenditures to ensure accurate financial reporting and maximise potential tax advantages, whether using a simple website builder or investing in a custom-designed ecommerce platform.

Intangible and intangible assets

Website development costs can fall under different tax and accounting treatments, depending on how the website is used.

- Some costs qualify as tangible assets, such as servers or computer equipment, while others relate to intangible assets like software or branding. The classification affects whether businesses can claim deductions immediately or spread them over time.

- The intangible assets regime applies to websites considered long-term business assets, such as those generating revenue through e-commerce or acting as a core part of operations.

In such cases, costs linked to development, design, and custom software may be treated as capital expenditure. If a business incurs costs related to upgrading or improving an existing site, these may also qualify as intangible assets and be amortised over their useful life.

However, websites used mainly for advertising or promotional purposes are usually treated as revenue expenses rather than capital investments. This means businesses can deduct the costs in the year they are incurred instead of spreading them over time.

Other considerations

Many new businesses ask, “How much does a website cost?”: The answer depends on several factors, including development, hosting, maintenance, and marketing.

Building a website involves several costs, depending on the features and functionality required. A content management system makes it easier to update and maintain a site, but choosing the right one affects both initial expenses and ongoing costs.

A basic site costs less, while a high-performing platform requires more investment. Free platforms exist, but businesses often need customisation, which increases spending.

Keeping contact details visible ensures potential customers can easily get in touch, improving engagement and conversions.

- Those developing complex websites may require advanced features such as e-commerce, databases, or integrations with third-party tools.

- Hosting also plays a key role, and while shared hosting is cheaper, a dedicated server offers better performance and security.

Businesses should assess their needs before deciding which option to invest in. Next – search engine optimisation.

A well-structured website needs search engine optimization to rank higher on search engine results, attracting more visitors. Investing in search engine visibility early prevents costly fixes later.

Ongoing improvements keep a website relevant, so budgeting for future updates is essential. Whether creating a new site or upgrading an existing one, planning for costs ensures the project stays on track and delivers value.

Compliance with tax regulations is an important factor. Businesses can claim capital allowances for certain expenses related to website development.

The rules around capital allowances for upfront website costs, ongoing website costs and hosting costs etc. vary. Therefore professional advice ensures you can cover all eligible costs.

Final thoughts

The tax treatment of website costs must be analysed against criteria set by HMRC, which defines categories of capital and revenue expenses. For unincorporated businesses, the classification of an expense as capital or revenue determines the tax treatment and eligibility for capital allowances.

For more guides on claiming expenses, please read:

- Self employed expenses – are you claiming everything you’re allowed to?

- Claiming expenses – the basics

- Jury service expenses

This blog covers a lot of technical details around tax and accounting treatment for website development costs. It would be completely understandable if you feel that you need more assistance or that you need to look into this further.

That’s what Howlader are here for and we’d be more than happy to help, so don’t hesitate to get in touch today.

If you need highly experienced and qualified London chartered accountants – look no further than the team at Howlader & Co. Choose a reliable, friendly and fast accountant London entrepreneurs and businesses trust with their money.