Director Salary 2025/26

Planning an optimal director salary for 2025/26

2025/26 – What’s changed?

Entering into 2025/26 the follow thresholds have remained unchanged:

- Primary Threshold (£12,570 / year)

- Personal allowance (£12,570 / year)

- Dividend allowance still at £500

- Basic rate band kept at £37,700

- Corporation Tax rates remain unchanged

Changes include:

- Primary NIC rate reducing to 8% (previously 10%)

- Secondary Threshold reducing to £5,000/year (previously £9,100)

- Employers’ NIC rate increasing to 15% (previously 13.8%)

- Employment Allowance increased to £10,500 (previously £5,000)

Primary NIC rate & threshold relates to the employee’s (or Director’s own) contributions. The secondary NIC rate & threshold relates to the employer’s (e.g. the company’s) contributions.

Findings

The primary threshold of £12,570 will be the optimal director salary in most cases.

Above this dividend usually remains an optimal extraction method.

A salary at the secondary threshold of £5,000 is now below the lower earnings limit and insufficient to obtain a qualifying year for state pension purposes.

For companies incurring marginal Corporation Tax at the main rate (generally companies with profits over £50,000/year) then a higher salary should be considered subject to the employment allowance being available.

For example, a company with two directors and no other employees would benefit from operating a director salary of £40,000 / each.

No Employment Allowance (E.A.) entitlement

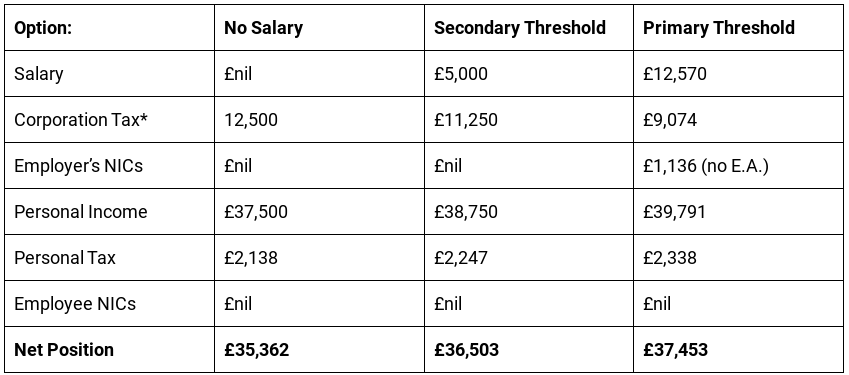

In the table below we’ve shown the position of a director withdrawing £50,000 or pre-tax profits via a different combination of salary and dividends.

*This table shows the impact where the Corporation tax is being charged at a 25% rate on the profits. The Corporation Tax figure shown is the amount relating to the £50,000 profits extracted.

Processing a director salary at £12,570 improves their net position by £2,091 a year (£37,453 with salary compared to £35,362 where no salary is processed).

The value of the benefit can vary between £1,340 /year to £2,278 / year subject to the marginal Corporation tax rate suffered by the company.

Employment Allowance (E.A.) Available – Two Directors

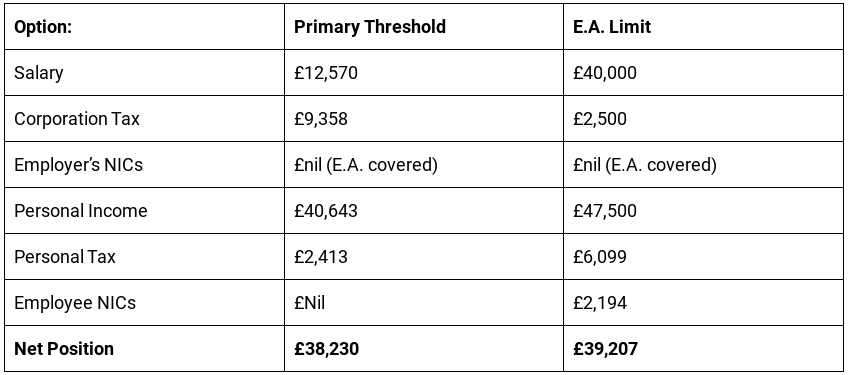

In the table below we’ve shown the position of a director withdrawing £50,000 or pre-tax profits via a different combination of salary and dividends.

Again, this uses a 25% Corporation tax rate and shows the Corporation tax figure for the £50,000 profits. Generally, a company will suffer 25% marginal Corporation tax where profits are in excess of £250,000.

Increasing the salary to £40,000/ each for two director’s results in total employer’s NICs of £10,500 which would be fully covered the employment allowance as a result no Employer’s NIC’s would be payable.

The net position of each director improves by £977 (£39,207 – £38,230).

Where the profits of the company are between £50,000 and £250,000 it will usually pay a marginal rate of 26.5% corporation tax. In this instance the saving rises even higher to £1,352 as will be relevant to many small businesses.

Where Corporation tax is incurred at 19% (profits up to £50,000) then the primary threshold salary of £12,570 remains the preferred level.

Other Considerations

The impact of student/ postgraduate loan repayments, the higher income child benefit charge and other sources of income can all impact director salary planning. If you would like bespoke advice, please contact us at info@howladerandco.com.

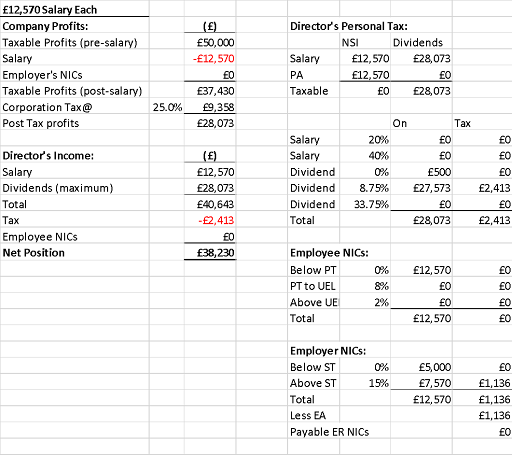

Calculations for Table two

Previous guides for wider reading are here:

If you need highly experienced and qualified London accountants offering a fast, reliable, friendly service – look no further than the team at Howlader & Co. Our experienced team – with some of the finest chartered accountants London has to offer – can help you.